Seabury Securities

Delivering investment banking & restructuring capabilities for Aviation and Aerospace & Defense

Restructuring, Turnaround & Investment Banking Capabilities

Leveraging Seabury Capital Group’s 25-year history of advising hundreds of key clients in the airline, aircraft leasing, OEM, and defense supply chain, Seabury Securities is the industry’s leading practice delivering global investment banking and restructuring capabilities focused on Aviation and Aerospace & Defense.

Our award-winning team with global access is led by a large senior leadership team with over 25 Managing Directors and Directors, boasting superior industry knowledge along with best-in-class analysis, technology, and solutions, as well as unmatched depth of relationships with decision makers in industry, finance, and government.

Senior Leadership Team

Our leaders are pioneers in aviation and aerospace with decades of executive leadership, deal making, and problem solving experience.

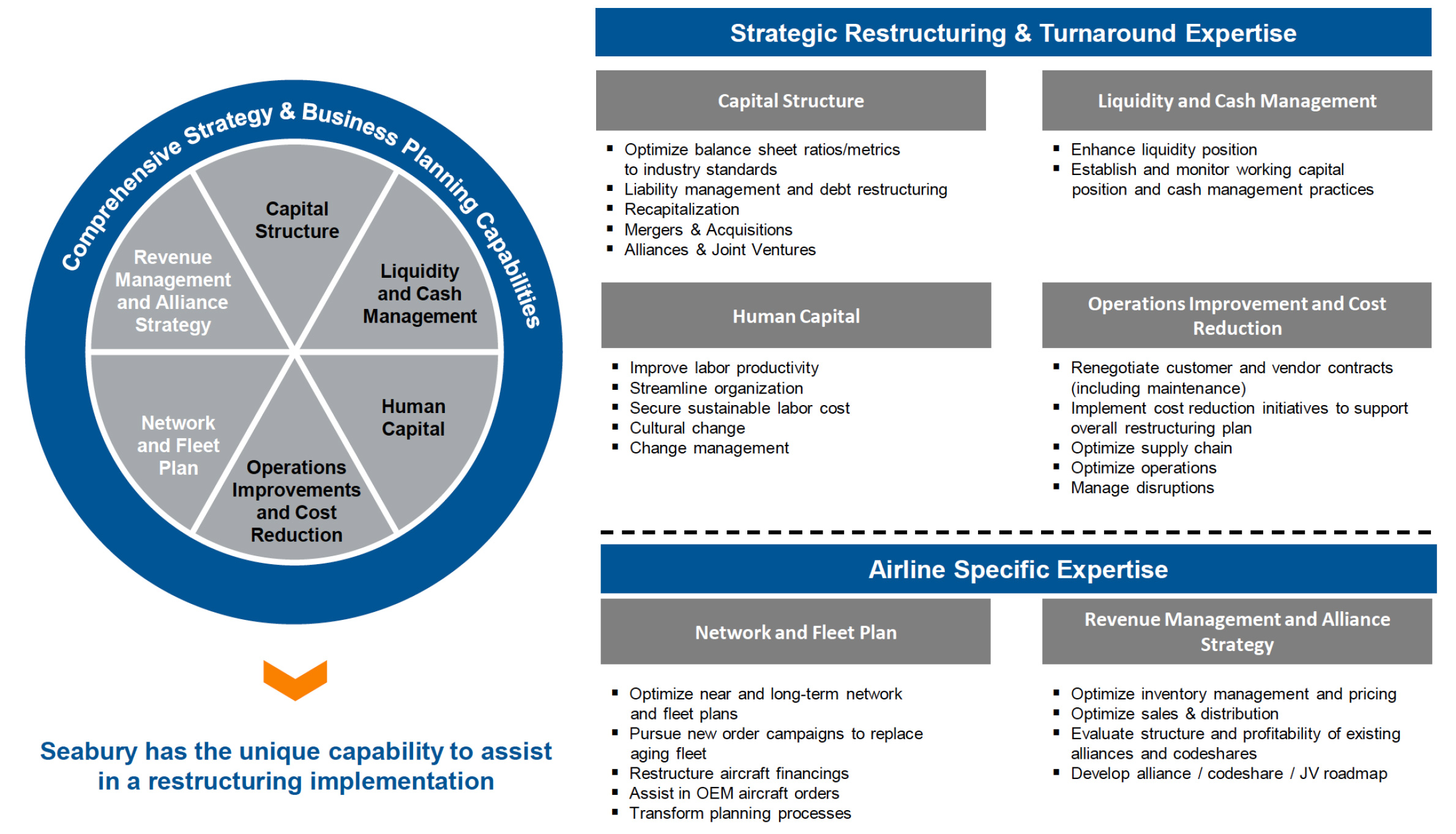

Multifaceted Functional Capability

Our team of experts has led 13 of the top 20 airline transformations as the sole restructuring advisor. Our professionals have deep expertise in lessor restructurings, helicopter operators, aerospace supply chain turnarounds, and maritime transformations, having conducted the restructuring of over $100 billion of obligations.

Restructuring & Turnaround Expertise

Through the alliance between Seabury Securities and Seabury Consulting (now part of Accenture), we deliver a full spectrum of value added services to assist industry in restructuring, turnarounds, cost control, M&A, and other strategic initiatives.

Strategy & Business Planning

- Review and redefine airline strategy and vision given current market conditions

- Develop a corresponding new business and financial plan

- Manage corporate turnaround

Capital & Debt Raising / Liquidity & Cash Management

- Secure capital to finance business plan, including private debt and private & public equity

- Facilitate aircraft financing

- Enhance liquidity position, and establish cash management practices

Aircraft Commercial Strategy: Fleet, Network, Revenue

- Review current network and schedule and rationalize as necessary

- Optimize selection of aircraft to match network plan and growth strategy

- Improve revenue management

Cost Reduction

- Achieve best in class cost position: maintenance, airports, distribution, catering and other key cost areas

- Implement a cash conservation/working capital improvement program

- Institute a cash management program

Labor Transformation

- Implement organizational redesign

- Identify, recruit, manage and retain talent

- Advise in labor negotiations

Ancillary Businesses

- Review ancillary business strategy: Cargo, MRO, Catering, Ground Handling, Frequent Flyer

- Develop full potential plan

- Evaluate M&A or commercialization/sale opportunities

Partnering/M&A Strategy

- Conduct due diligence on potential acquisitions

- Identify, solicit and filter potential buyers

- Coordinate deal process

- Manage the post merger integration process

Asset Financing Expertise

Our team provides unbiased advice in structuring and restructuring of debt facilities and leases, as well as assistance in originating and executing sale leasebacks, cross border tax leases, JOLCOs, export credit, bank, direct lending, insurance debt, and PDP financings.

- Fleet & Financing Strategy

- OEM Negotiation

- Lease vs. Buy Analysis

- PDP Financing

- Long Term Debt Financing

- Lease Renewals & Buyouts

- Fleet Monetization & Disposition

explore our businesses

Seabury Capital delivers diversified and responsive business solutions to clients across many industries

Industry-leading practice delivering global restructuring and investment banking capabilities to aviation clients worldwide

Managing funds with investments in aviation, aerospace, logistics, travel, and technologies

Providing secured working capital financing for manufacturers and other suppliers of goods and services

Delivering global restructuring, turnaround & investment banking capabilities to clients in Aviation and Aerospace & Defense

Aircraft Technical Asset Management

Delivering proven capabilities covering a full range of aircraft and engine-related services

provides cutting edge software, data and IT solutions for the airline industry

Providing solutions and financial products to match clients’ investment criteria