Seabury Capital Announces Executive Leadership Appointments

Seabury Capital (“Seabury”), a leading global advisory and professional services firm, announced today a number of executive promotions within its aviation consulting and corporate finance groups, which aim to leverage Seabury’s global brand, core competencies and industry expertise to continue to expand its worldwide customer base across the aviation industry.

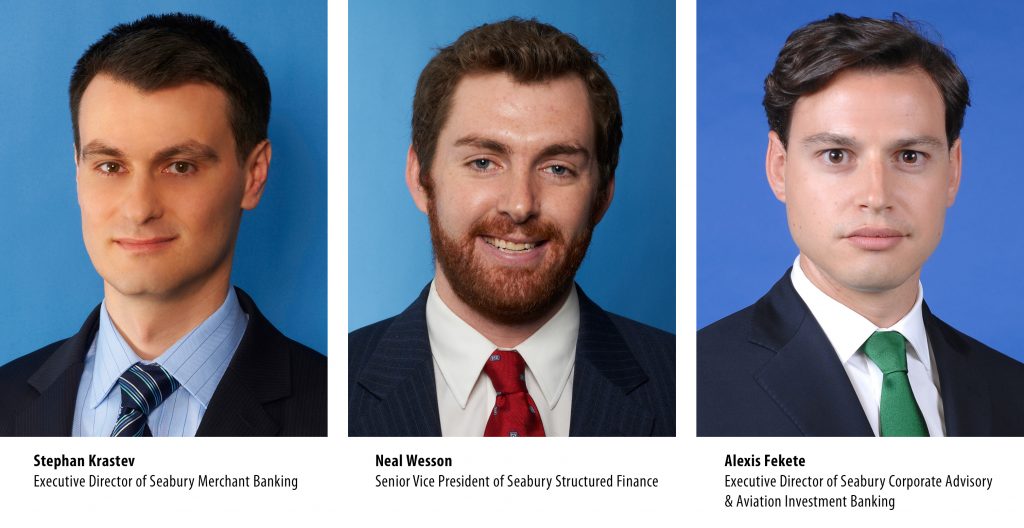

Stephan Krastev has been promoted to Executive Director of Seabury Merchant Banking. Since joining Seabury in 2002, Mr. Krastev has structured and executed a broad range of transactions, including capital raising, M&A advisory (buy- and sell-side) and in- and out-of-court turnarounds. Mr. Krastev is currently involved in a number of capital raising processes for Seabury’s proprietary aviation asset management initiatives.

Stephan Krastev has been promoted to Executive Director of Seabury Merchant Banking. Since joining Seabury in 2002, Mr. Krastev has structured and executed a broad range of transactions, including capital raising, M&A advisory (buy- and sell-side) and in- and out-of-court turnarounds. Mr. Krastev is currently involved in a number of capital raising processes for Seabury’s proprietary aviation asset management initiatives.

Neal Wesson has been promoted to Senior Vice President of Seabury Structured Finance. Since joining Seabury in 2007, Mr. Wesson has worked on a wide range of transactions consisting of arranging and structuring debt, lease and private placement financings for commercial and business aircraft, engines and parts, in- and out-of-court restructurings and aircraft remarketing.

“Both Stephan and Neal are excellent examples of Seabury experts who continue to leverage our global brand, core competencies and industry expertise to provide the much-needed solutions to our growing customer base both in the leasing and airline sectors, as well as develop and launch new business initiatives,” commented Patrick Henry Dowling, President & Chief Executive Officer of Seabury Corporate Finance LLC.

In addition, Alexis Fekete has been appointed Executive Director of Seabury Corporate Advisory & Aviation Investment Banking. Since joining Seabury in 2010, Mr. Fekete has been instrumental in serving the company’s aviation and aerospace clients across the globe, providing specialized expertise in M&A, financial restructuring, capital & debt raising, aircraft financing, and airline and lessor due diligence. Most recently, Mr. Fekete has been a senior advisor on the following engagements: TAP Portugal privatization buy-side & debt restructuring advisory, as well as Monarch Airlines and Air Nostrum debt restructuring and capital raises.

Michael B. Cox, Vice Chairman, Seabury Advisory Group, and Global Head of Corporate Advisory Services, commented: “Alexis has been with Seabury for six years and has been instrumental in serving our clients across the globe. He is a member of our industry-leading team that advised numerous airline clients on a variety of projects, including airline M&A, corporate finance, and airline restructuring.”

Today Seabury is a leading global advisory and professional services firm that delivers diversified and responsive business solutions to clients in Aviation, Aerospace & Defense, Transportation and related industries. With a network of professionals on five continents and more than 15 countries, the company has partnered with more than 300 clients in over 50 countries on 1,200 engagements to solve their most complex challenges through an integrated approach to consulting, investment banking, asset management, and information technology.

Learn more about Seabury’s aviation consulting and corporate finance services.

ABOUT SEABURY GROUP

Seabury Capital LLC is a global firm founded in 1995 with two principal groups, Seabury Advisory Group LLC (“SAG”) and Seabury Capital LLC (“SeaCap”). SAG is a global advisory practice with professionals on five continents and more than 15 countries covering Aviation, Aerospace & Defense, Financial Services, Government Services, Logistics, Maritime, Transportation and related industries. SAG has partnered with more than 300 clients located in more than 50 countries on more than 1,200 engagements to solve complex challenges requiring consulting, investment banking, restructuring and/or information technology solutions.

SeaCap owns and operates a number of specialty finance companies providing innovative cross-border financing for equipment and trade receivables as well as insurance-backed auto service and financial obligations. SeaCap recently launched a merchant banking business to take minority equity positions in, and to provide debt financing to, middle market companies. SeaCap also owns software companies providing enterprise solutions to airlines, aerospace companies and provides a range of electronic trading solutions to buy-side and sell-side firms in the Foreign Exchange market. www.seaburygroup.com